Get A Free Quote

We put the CARE in Medicare!

Medicare plays a crucial role in keeping you healthy, but with all the different parts, plans, and rules, it can feel like trying to solve a puzzle without all the pieces. At Gary Smith Medicare Agency, we specialize in helping Long Beach residents understand their Medicare options and get the coverage they need.

Whether you need to change plans, update your prescription coverage, or simply confirm that everything is still working for you, our local experts are here to guide you. Let’s walk through some of the essentials of Medicare and how to make the most of open enrollment.

What Is Medicare Open Enrollment?

Medicare open enrollment is the annual period from October 15 to December 7 when Medicare beneficiaries can review and make changes to their plans. Any adjustments made during this time will take effect on January 1 of the following year.

You can use this time to:

- Switch from Original Medicare (Part A and Part B) to a Medicare Advantage Plan.

- Change from one Medicare Advantage Plan to another.

- Drop or switch your Medicare Part D prescription drug plan.

- Make sure your doctors and prescriptions are still covered by your plan.

- Explore new plan options if your current plan no longer fits your needs.

- Avoid potential penalties by switching or enrolling on time.

Miss the deadline? If you don’t make necessary changes by December 7, you’ll likely have to wait until the following year’s enrollment period to adjust your plan.

Key Medicare Terms to Know

Understanding Medicare starts with knowing some basic terms. We put together a short list of keywords that may come up while you research your Medicare options:

- Medicare Part A: Covers Inpatient care. Examples: hospital stays, skilled nursing care, and some home health services.

Most people don’t pay a premium for Part A if they’ve worked and paid taxes for at least 10 years.

- Medicare Part B: Covers outpatient care. Examples: doctor visits, preventive services, and medical supplies.

Part B requires a monthly premium, and costs may increase if you don’t sign up on time or make too much money.

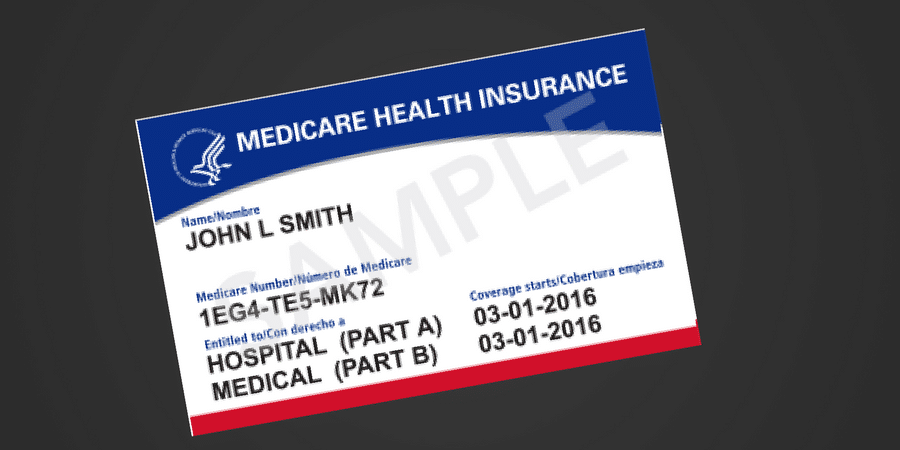

NOTE: Part A and Part B above is your RED, WHITE AND BLUE Medicare card. Don’t let Part C or D confuse the issue. See the below card, it has Part A and Part B only.

- Part C and Part D

Original Medicare: IE your Red white and Blue card does not provide 100% coverage, nor does it provide Drug coverage. Therefore, you need to pick up some additional coverage. Below are your options.

Option One:

- Medigap or (Medicare Supplement): This is a Private Insurance policy that helps cover the gaps not covered by Original Medicare. When you go to your doctor, you will show your Medicare card and your Supplement card. Since Medicare does not cover drugs, you will need to buy drug coverage via a Part D Medicare Drug plan.

- Medicare Part D: Helps cover the cost of prescription medications.

Different plans offer varying levels of coverage, so it’s important to choose one that meets your medication needs.

Note: With the Supplement, you will need to keep up with Three Cards. Your Medicare Card, your Supplement card and your drug coverage card.

- Medicare Advantage or (Part C): What is Medicare Advantage and why was it born. Many Seniors did not want to keep up with three cards. They wanted a Medicare plan that mimicked their group work coverage. Meaning one card that covered Doctor, Hospital and drugs like there work coverage plus a copay to see the doctor.

NOTE: You do not lose Medicare, that is a myth. You MUST have Medicare to enroll in the Advantage plans. These plans are offered by private insurance companies and provide Seniors an option to original Medicare and three cards.

How to Prepare for Medicare Open Enrollment

It’s easy to feel overwhelmed by all the options and deadlines, but a little preparation goes a long way.

Here are some simple steps to help you get ready:

- Review Your Current Coverage

Start by looking at your current Medicare plan. Have your healthcare needs changed? For example, if you’ve been prescribed new medications this year, it’s important to confirm that your plan still covers them affordably.

Look at costs. If your premiums or copays have increased, it might be time to explore other options that better fit your budget.

- Compare Plans for 2025

Medicare Advantage and Part D plans can change their networks and coverage each year. During open enrollment, you can explore plans to make sure your preferred doctors and pharmacies remain in-network.

At Gary Smith Medicare Agency, we help compare plans side by side, explaining the pros and cons in simple terms—so you can choose with confidence.

- Consider Future Needs

Think ahead. Are you planning any surgeries or medical treatments next year? Do you need

out-of-state coverage for travel? Now is the time to make sure your plan will work for the life you envision in the year ahead.

Common Medicare Mistakes to Avoid

It’s easy to overlook small but important details. We see all kinds of situations and have gathered these common mistakes from our experience.

Here are some common mistakes we help our clients avoid:

- US based Customer Service: Don’t assume the customer service is US based. Ask!!!!

- Don’t talk to a Medicare Sales Person on the phone if you did not ask them to call you.

- Assuming your plan hasn’t changed. Networks and coverage can shift yearly—always double-check that your doctors and pharmacies remain in-network.

- Overlooking new medications. Plans can change their drug coverage, so it’s essential to ensure your prescriptions are covered.

- Missing the open enrollment deadline. If you don’t act by December 7, you’ll have to wait another year to make changes.

Why Work with Gary Smith Medicare Agency?

Local Experts, Personalized Care

At Gary Smith Medicare Agency, we know Long Beach, MS, and the healthcare providers in this community. We work with local doctors and hospitals to help you select the right plan for your needs. Our personalized guidance ensures you won’t run into surprises when it comes to coverage.

No Extra Cost for Our Services

Many people assume that using a Medicare agent costs more—but that’s not true. Whether you work with us or enroll on your own, the cost of your plan remains the same. With Gary Smith Medicare Agency, you get personalized support without paying a penny more.

One-on-One Support Without the Hassle

No one likes automated phone systems. When you work with us, you won’t deal with frustrating menus or chatbots. You’ll speak directly with a knowledgeable agent who is ready to answer your questions and guide you through the process. And YES, you can speak to the same person over and over.

Let’s Make Medicare Simple—We’re Here to Help

At Gary Smith Medicare Agency, we know that choosing the right Medicare plan is about more than just coverage—it’s about peace of mind. Whether you’re reviewing your plan for 2025, exploring new options, or just have a question, we’re here for you every step of the way.

Our team is ready to provide personalized, one-on-one support. We’ll make sure your plan fits your health needs, your budget, and your lifestyle.

Gary Smith Agency: We put the CARE in Medicare.

© 2024 Gary Smith Agency. All rights reserved.

Comprehensive Medicare Services in Pascagoula

We offer a wide range of Medicare services near Pascagoula residents that are tailored to individual needs:

Medicare Advantage Plans

Explore our range of Medicare Advantage plans designed to provide comprehensive coverage, including prescription drug benefits and additional services not covered by Original Medicare. Our Medicare Advantage plans offer a convenient all-in-one solution for your healthcare needs.

Medicare Supplement Insurance

Learn about the benefits of Medicare Supplement plans, also known as Medigap, which help fill the gaps in coverage left by Original Medicare. These plans can help cover out-of-pocket costs such as copayments, coinsurance, and deductibles, providing you with greater financial security and peace of mind.

Prescription Drug Coverage (Part D)

Discover our selection of Medicare Part D plans that offer prescription drug coverage to help you afford the medications you need while minimizing out-of-pocket costs. Our agents will help you find a plan that covers your prescriptions at a price that fits your budget.

Medicare Resources and Education

Access valuable resources and educational materials to better understand your Medicare options and make informed choices about your healthcare coverage. Our goal is to empower you with the knowledge you need to make the best decisions for your health. Visit our video library for more information.

Why Choose Gary Smith Medicare Agency?

Local Expertise in Pascagoula, MS

As your local Medicare experts in Pascagoula, we understand the unique healthcare needs of our community and can recommend tailored solutions to meet those needs. Our familiarity with healthcare services ensures you get the best advice and coverage on Medicare.

Personalized Service

We take the time to listen to your concerns and preferences, providing personalized guidance and support throughout the Medicare enrollment process. Our agents are dedicated to helping you find a plan that fits your specific needs and lifestyle. Don’t risk not getting it done right.

Trusted Advice on Medicare Locally

With years of experience in the Medicare industry, our knowledgeable agents are committed to helping you find the right coverage at the right price. Our team has a deep understanding of the intricacies of Medicare plans and the ever-evolving landscape of healthcare insurance. This expertise allows us to provide you with the most relevant and current information, ensuring that you make well-informed decisions about your Medicare coverage.

Related Terms:

- Medicare coverage in Long Beach, MS

- Long Beach Medicare enrollment assistance

- Local Medicare expert Long Beach MS

- Best Medicare guidance in Long Beach

- Reliable Medicare services Long Beach MS

- Affordable Medicare coverage Long Beach

- Professional Medicare reviews Long Beach

- Medicare open enrollment Long Beach MS

Nearby Locations:

Moss Point, MS

Gautier, MS

Escatawpa, MS

Helena, MS

Kreole, MS

Hurley, MS

Vancleave, MS

Ocean Springs, MS

St. Martin, MS

Latimer, MS

Big Point, MS

Wade, MS

D’Iberville, MS

Biloxi, MS

Gulf Hills, MS

Lucedale, MS

Perkinston, MS

Agricola, MS

Leakesville, MS

Wiggins, MS